gm. Forbes' annual Midas List ranking the best VCs in the world dropped yesterday and Chris Dixon of a16z snagged the top spot.

Another interesting tidbit: out of the top ten investors on the list, only 3 have HQ’s located in San Francisco.

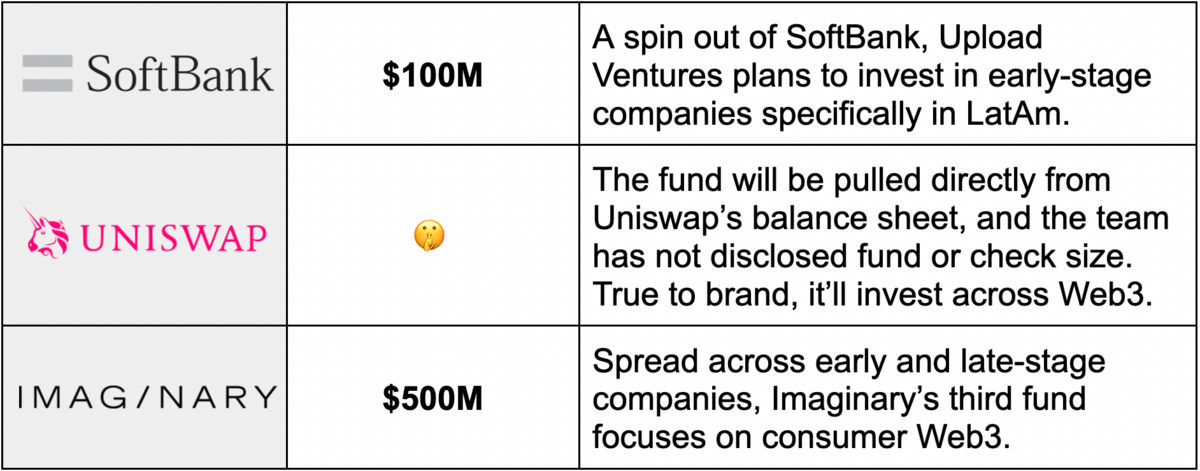

FRESH POWDER

Looking at three funds that recently topped up their coffers.

METAVERSE

Meta's merchants monetize

Meta

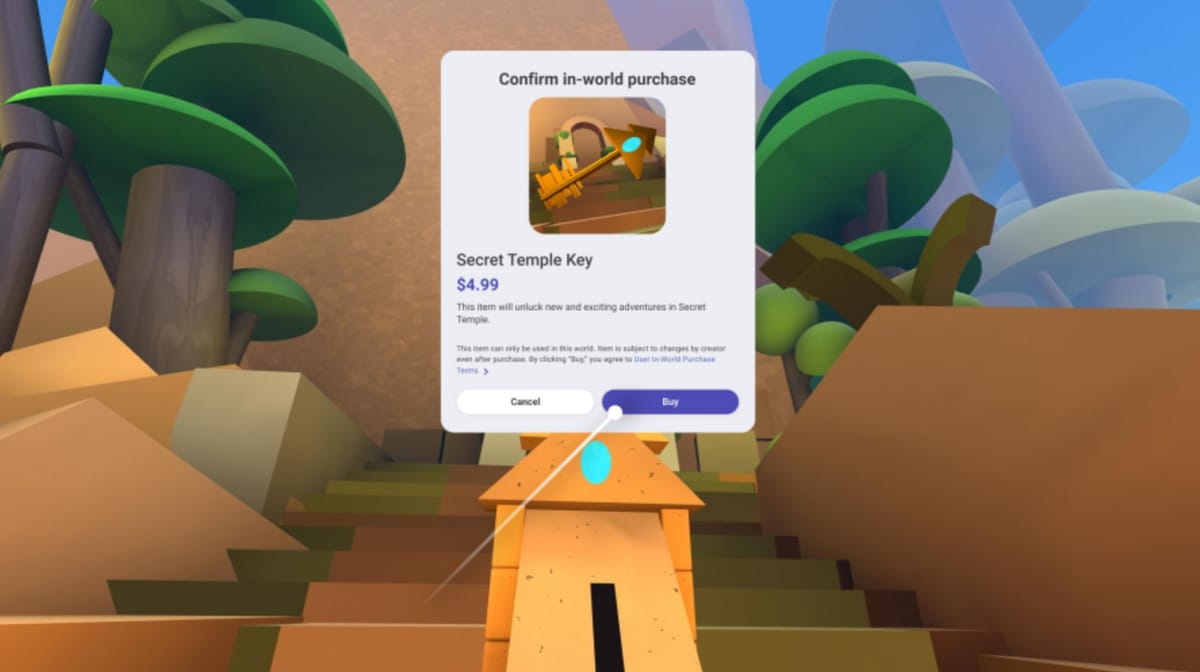

Meta is ramping up its metaverse monetization: in a Monday blog post, the company announced that it is rolling out a pilot program that lets creators sell virtual goods in Horizon Worlds, its VR game creation platform

Zuck is after his bucks

When Facebook went fully down the metaverse rabbit hole last October, its ambitions were grandiose, but its path to monetization wasn't fleshed out. After Monday’s announcement, it appears that building out a metaverse economy is step one.

Creator focused: The Horizon Worlds platform allows creators to build their own metaverse worlds for people to enjoy. The new pilot program gives those creators a way to monetize their worlds by selling in-game items. Essentially, creators get to set up their own economy within their own worlds.

Zuck’s cut: Meta is taking a fees that would make Apple blush. First, Meta takes a platform fee of 30% for sales made on Meta Quest, the hardware headset that powers its VR world. On top of that, all purchases made within Horizon Worlds come with a 25% sales fee. Add it all up and Meta is scraping 47.5% off the top in some cases.

Meta wants Horizon Worlds item sales to be a meaningful revenue generator for the company much like Apple’s App Store. But that’s assuming creators will actually want to build on Horizon Worlds and that consumers will want to buy what the creators are hawking. Both big “ifs.”

Zoom out: The program’s success could lead to an even bigger metaverse gold rush than the funding bonanza of 2021, but if it flops, the idea of building distinct and interoperable metaverse economies becomes even more far-fetched.

CRYPTO

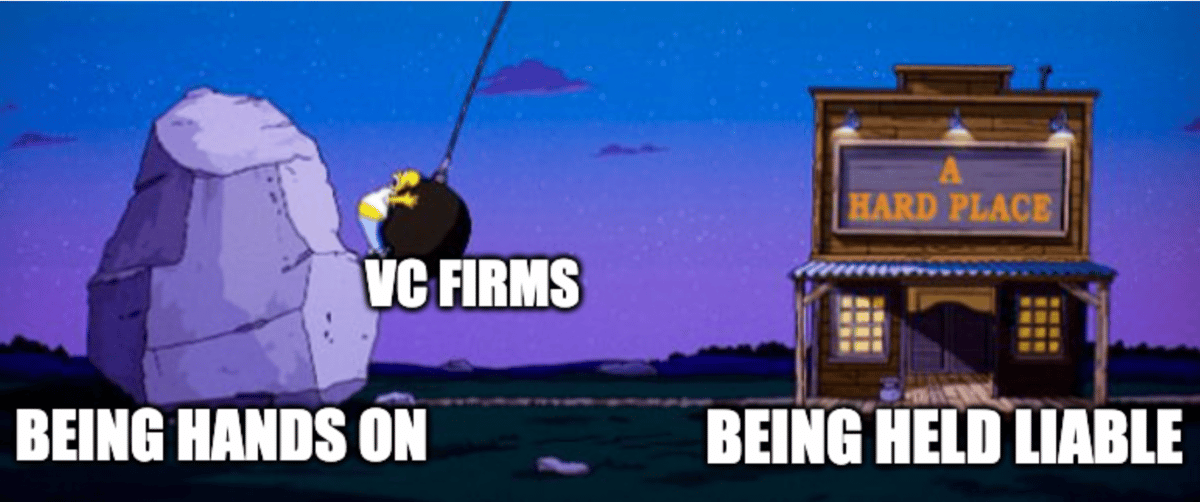

Caught between a rock and a lawsuit

Paradigm, a16z, and Union Square Ventures caught a stray last week: the three VCs were directly named in a class-action lawsuit against Uniswap that alleges they were deeply involved in developing Uniswap and thus should be held liable for the “rampant fraud” occurring on its platform. It’s an interesting case that reveals some of the hazards of the hands-on model that many firms are taking with crypto companies.

Where does the buck actually stop?

The lawsuit against Uniswap claims that the funds’ contributions to building, supervising, and promoting the platform make them responsible for fraudulent or illegal activity on it.

It argues that Uniswap, and the VCs on its term sheet, have been looking the other way when it comes to pump-and-dump schemes and rug pulls that have occurred on the exchange, as they stand to turn a profit from scams.

Bottom line: Many funds may find themselves between a rock and a hard place going forward. With capital becoming increasingly commoditized, it's essentially table stakes for VCs to offer more hands-on support to companies they hope to invest in. But, as this high-profile examples show, that increased level of involvement leaves funds open to more liability lawsuits.

QUICK HITS

Seed round

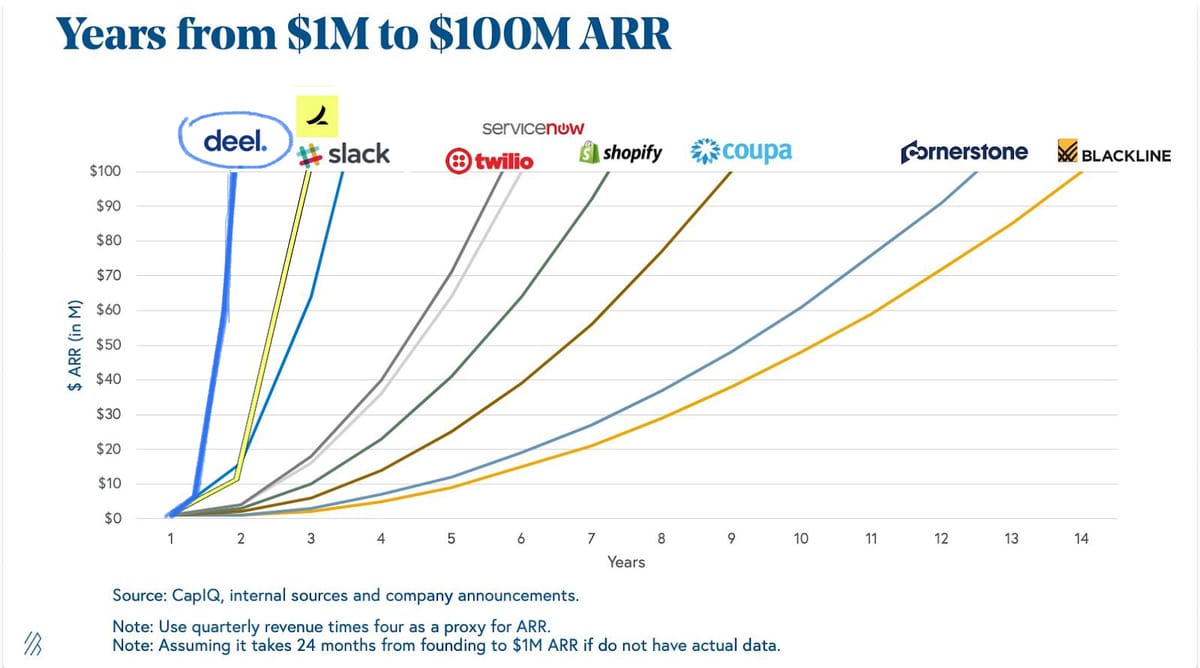

Deel

Stat: Deel, a startup that helps customers hire in other countries, hit $100 million ARR faster than any company ever. Just look at that chart.

Startup: Meet Gen Z’s new favorite app, BeReal. Once a day, the app prompts you to take a pic from your phone's front and back cameras at the same time, showing where you are and what you’re doing. No editing allowed. (More here)

Rabbit hole: It’s official: astronomers have discovered another earth (Physics-Astronomy)

WHAT ELSE IS GOING ON

Ukraine’s cybersecurity agency foiled an attempt by a Russian hacking group to cause another blackout.

Circle, one of the founders of USDC, closed a $400 million raise.

Tech firms including Alphabet, Meta, Stripe, and more announced Frontier, an initiative that will invest almost $1 billion in carbon capture.

Honda plans to invest $40 billion in EVs.

TRIVIA

Drop-outs are mythical beings in the founder world. Which universities did these billionaires decide were beneath them before going on to found their companies?

Bill Gates

Elizabeth Holmes

Michael Dell

Travis Kalanick

FOUNDERS CORNER

The best resources we came across that will help you become a better founder, builder, or investor.

🤖 Some cool experiments conducted by the Figma founder using the AI image generator DALL-E

💰 Unbundling Zapier is a $5 billion opportunity

📢 Sam Altman strongly recommends writing a personal career mission statement

TRIVIA ANSWER

Bill Gates - Harvard

Elizabeth Holmes - Stanford

Michael Dell - UT Austin

Travis Kalanick - UCLA

This trivia was brought to you by @triviacorner