Gm. If you’re a founder who’s gonna be around for LA Tech Week, we’ve got an event you don’t want to miss: the biggest demo day of the year.

We’re hosting the event in tandem with Stonks and a16z and will be joined by judges Nikita Bier, Turner Novak, Andrew Chen, and Sophia Amorusu.

We reserved 3 spots specifically for Homescreen readers to take part in the pitch competition so submit your application ASAP.

If one of you wins the competition, we’ll give you a shout-out in the newsletter too.

Good luck!

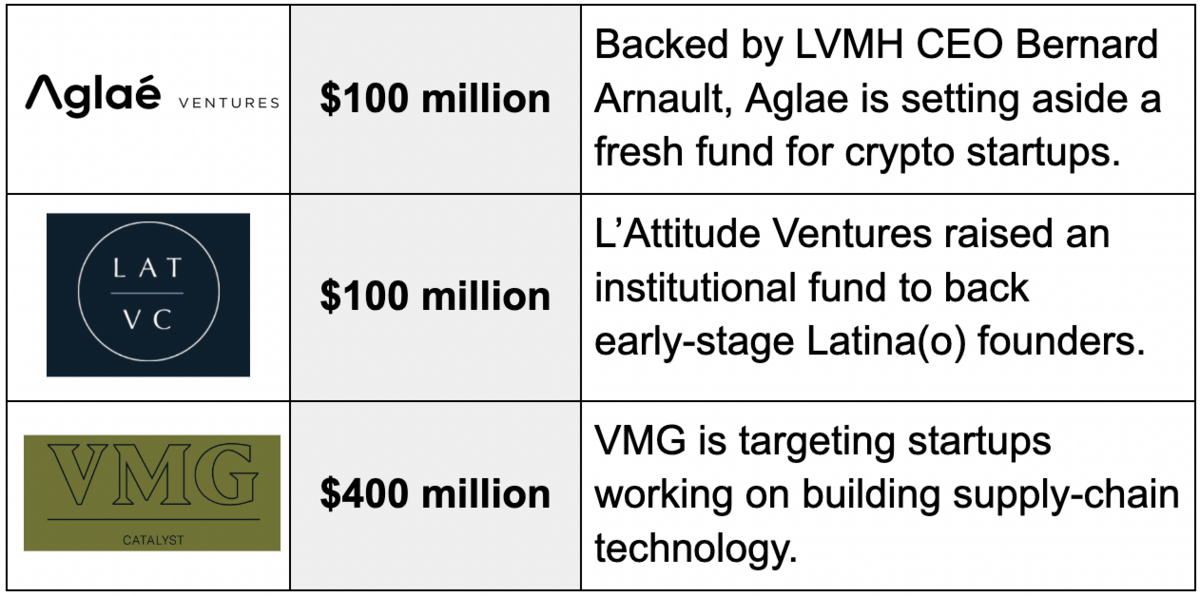

FRESH POWDER

Looking at three funds that recently topped up their coffers.

CRYPTO

Some rare Ws for Coinbase

It’s not often that Coinbase makes positive headlines recently, but yesterday the crypto exchange announced a double dose of good news.

First, it revealed a partnership with BlackRock to provide the clients of the largest asset manager in the world with access to crypto trading.

Separately, Meta announced it was including Coinbase Wallet as one of the third-party wallet options for NFTs on Instagram.

Investors liked what they were seeing: Coinbase’s beleaguered stock popped as much as 40% yesterday before closing the day up 10%.

But which partnership is more significant?

The BlackRock announcement made it seem like institutions have been clamoring for a way to buy crypto: “Our institutional clients are increasingly interested in gaining exposure to digital asset markets,” Joseph Chalom, BlackRock’s global head of partnerships, said in a statement.

Okay, maybe not clamoring, but still, it’s a positive sign for Coinbase that the biggest players in the world want a taste of crypto Kool-Aid.

However, the Meta deal might be more significant in the long run. Yes, it's ironic that Instagram is expanding its NFT platform to 100 more countries right when trading volume bottoms out, but the scale of IG is hard to ignore. If Meta is doubling down on NFTs—which it appears it is after Zuck put his old Little League baseball card up for sale yesterday—Coinbase is wise to ride the wave.

Buzzy partnerships aside, Coinbase still has an uphill battle to get back to its old trading volumes and growth targets. Tangible revenue from the deals won't show up on the balance sheet anytime soon, and even when they do, there’s no telling if they'll pack enough punch to dig Coinbase out of its current hole.

Zoom out: Coinbase reports second quarter earnings next week so we’ll get to see if the numbers are a vibe killer or not.

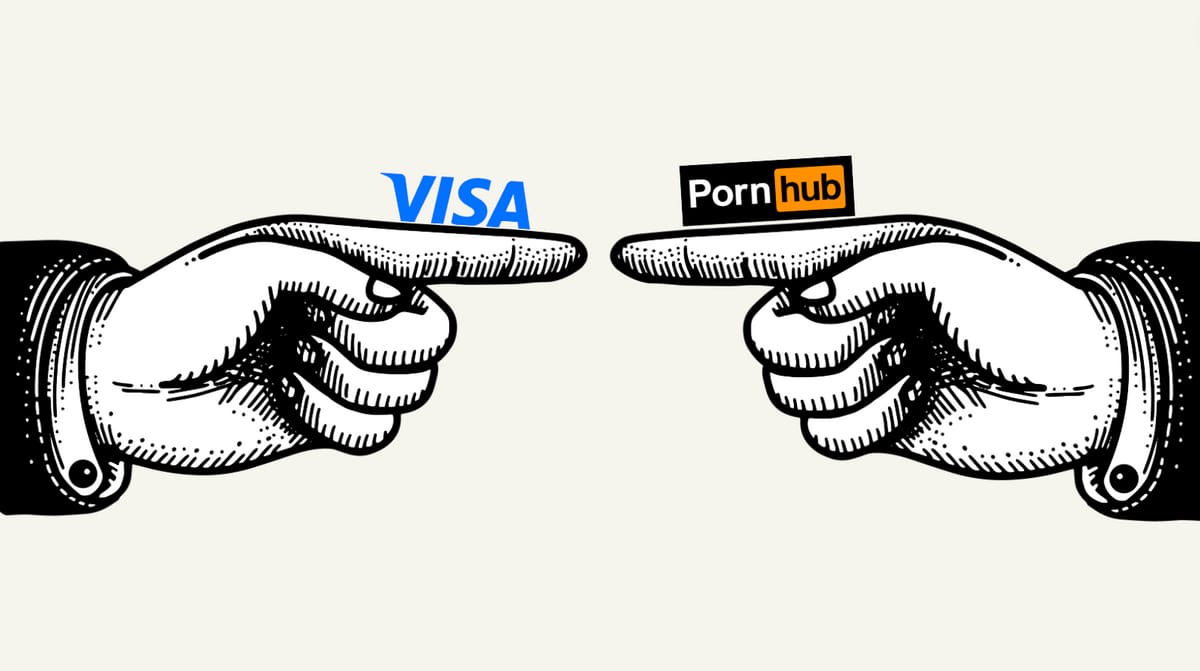

LEGAL

Pointing fingers

Visa and Mastercard stopped facilitating payments for advertisers on MindGeek (the owner of Pornhub) yesterday. The decision comes after a federal judge refused to dismiss a lawsuit accusing Visa of being complicit in the distribution of non-consensual videos depicting child pornography.

It’s opened a can of worms around who’s responsible for the content

The suit alleges that Visa plays a significant role in content moderation given its power as a payment processor.

US District Judge Cormac Carney pointed to MindGeek’s removal of 80% of its content after Visa suspended payment privileges back in 2020 as proof that Visa does exert some control over content boundaries.

But Visa countered that the ruling sets a dangerous precedent for payment processors, arguing that the people who posted and distributed the images are the ones directly responsible.

Zoom out: Visa is correct in saying that the ruling does pave the way for payment companies to face civil and criminal consequences. But whether Visa’s argument that a ruling “would upend the financial and payment industries,” has merit remains to be seen.

QUICK HITS

Seed Round

Stat: To anyone sleeping on the job, you might just hold a coveted skill in today’s labor market. The mattress company Casper announced that it’s hiring three professional “Sleepers” to sleep on its beds for a cool $25/hr. The dream candidate must have “exceptional sleeping ability” and “a desire to sleep as much as possible,” which means every college kid or big tech PM will be submitting an application shortly.

Story we’re watching: Things are looking a little sunnier for $SOL these days. After an investigation of the 9,000 Solana wallets drained by hackers earlier this week, Solana reported that all of the impacted wallet addresses were at one point created or used on the Slope mobile wallet. The attack occurred after thousands of private keys were accidentally transferred to an application monitoring service. While the details are still up in the air, the popular L1 noted that “there is no evidence the Solana protocol or its cryptography was compromised.”

Rabbit hole: The modern space race (WSJ).

WHAT ELSE IS GOING ON

Lucid Motors slashed production forecasts for the second time this year. It was originally shooting for 20,000 vehicles but now estimates it will make just 6,000 to 7,000.

Starbucks is releasing an NFT-based rewards program for exclusive content and other perks.

Clubhouse is beta-testing a new feature called “Houses” which would let users create private communities.

Alex Jones must pay $4.1 million for spreading Sandy Hook conspiracy theory

GUESSTIMATE

Coinbase jumped as much as 40% yesterday, but it’s still trading wayyyyy below its direct listing price.

At its close on Thursday it was worth ~$18 billion: how much was it worth on the day it direct listed 15 months ago?

FUNDRAISING FRIDAY

It may feel far away now, but the day might come when you decide to sell your startup.

Here are some helpful lessons to guide the process.

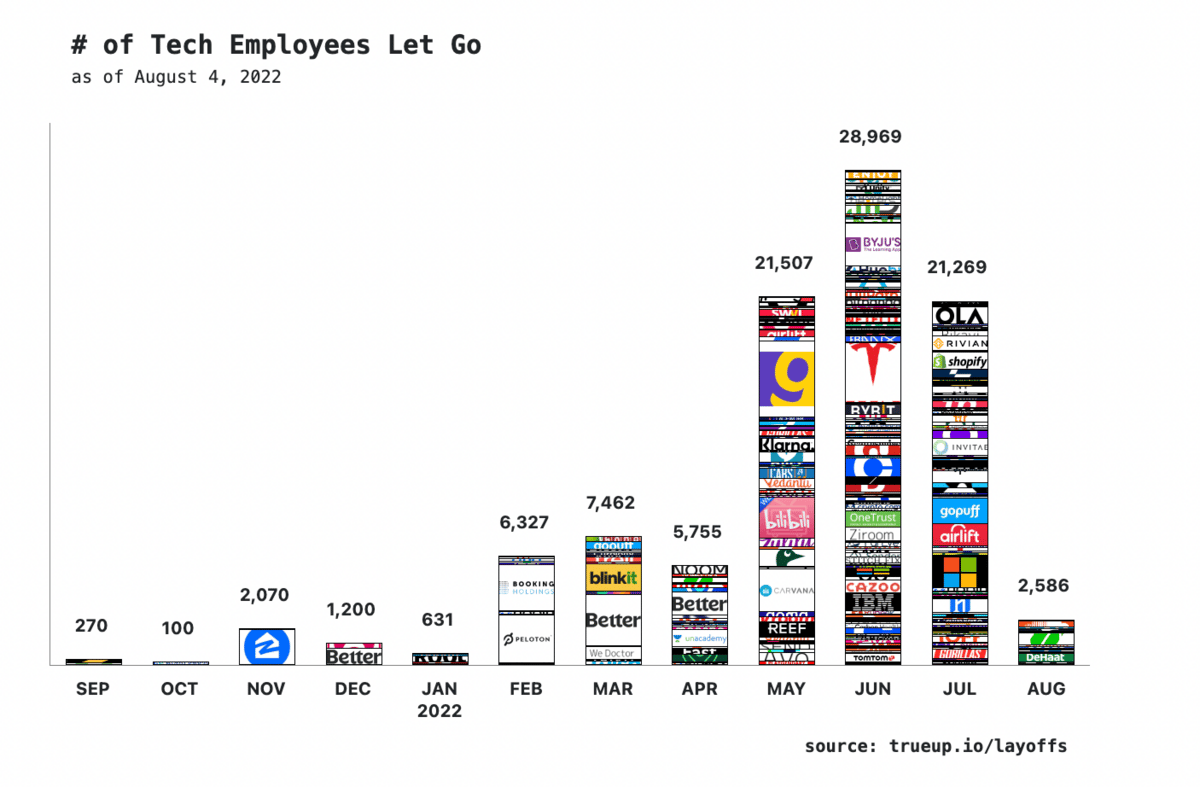

LAYOFFS TRACKER

Notable layoffs this week:

SoundCloud: 340 people (20%)

OnDeck: 73 people (~35%)

Unbounce: 47 people (20%)

FOUNDERS CORNER

The best resources we came across this week that will help you become a better founder, builder, or investor.

💆 The Verge’s favorite and most effective ways to relieve stress

😎 A running thread on how to be independent as a developer

✍️ 10 investor terms every entrepreneur should know

GUESSTIMATE ANSWER

$86 billion.