Gm. If you never look at your portfolio, the numbers can't go down. It's science.

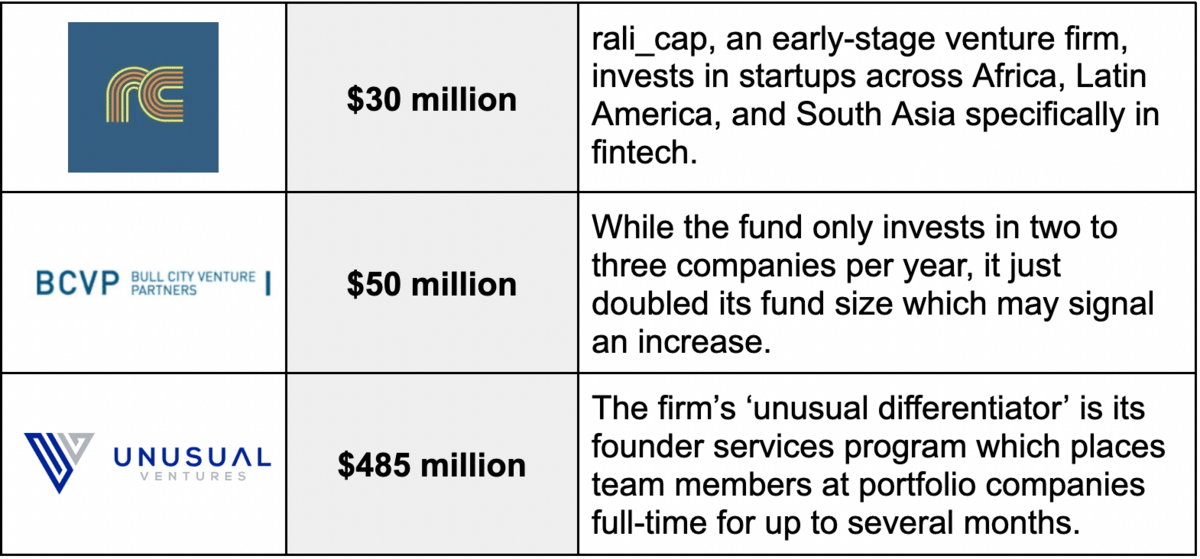

FRESH POWDER

Looking at three funds that recently topped up their coffers.

STARTUPS

The layoffs are here

After months of apprehension, the deluge of startup layoffs that many had been predicting came flooding in all at once. Here’s who has reduced headcount in the past few days alone:

Cameo, the pandemic darling that allows people to pay celebrities to send customized videos, kicked things off Tuesday by announcing it was laying off more than a quarter of its employees.

Then, Mainstreet, a fintech company announced yesterday that it had laid off about 30% of its staff citing an “incredibly rough market.”

Finally, On Deck, a company that connects founders to each other, capital, and advice, rounded out a grim 48 hours by laying off 25% of its staff in an all hands meeting.

According to Layoffs.fyi, a website that tracks startup layoffs, a whopping 34 companies have already trimmed headcount since Q2 began. For context, only 24 companies were cited by the tracker over the entirety of Q1. The pace of layoffs is increasing.

What the heck is going on?

When mass layoffs start rolling in, it’s usually a case of revenue not staying pace with payrolls that have been heavily subsidized by VC money. And companies with bloated valuations from the boom times of the past two years are finding it harder to raise fresh powder to keep paying their employees

Look no further than the $11 billion one-click checkout company, Bolt, for a startup that has struggled mightily to raise new funds due to its huge valuation on not-so-huge revenue.

Zoom out: Even though startups may be tightening up their head counts, the broader labor market is still aching for workers—as of March, there are roughly two job openings for every unemployed person right now.

Elon gets a little help from his friends

Elon Musk is putting together a team of financial Avengers to take some pressure off his pocket book and help complete his $44 billion acquisition of Twitter.

That list includes:

a16z, because it’s never met a deal it doesn’t like

Sequoia Capital, which also has a stake in SpaceX

Larry Ellison, a good buddy of Elon who also holds a $14 billion take in Tesla.

Qatar’s sovereign wealth fund which is upping its existing stake in the company (though the presence of the repressive regime is a bit odd considering Elon’s free speech absolutism.)

It’s likely the group above is being pitched on a slimmed-down, iterative, and profitable Twitter. One that features Musk himself as temporary CEO. Together the capital contributions total $7.1 billion, drastically reducing Musk’s personal obligation in the $44 billion deal.

Zoom out: There’s also a potential Web3 angle here. Binance, the worlds largest crypto exchange, has also committed $500 million towards Elon's takeover bid. Its CEO and founder, Changpeng Zhao said he hopes to “play a role in bringing social media and web3 together.” Again, not a lot of details floating around, but it is fun to think about what CZ and Elon might cook up on the crypto front.

QUICK HITS

Seed Round

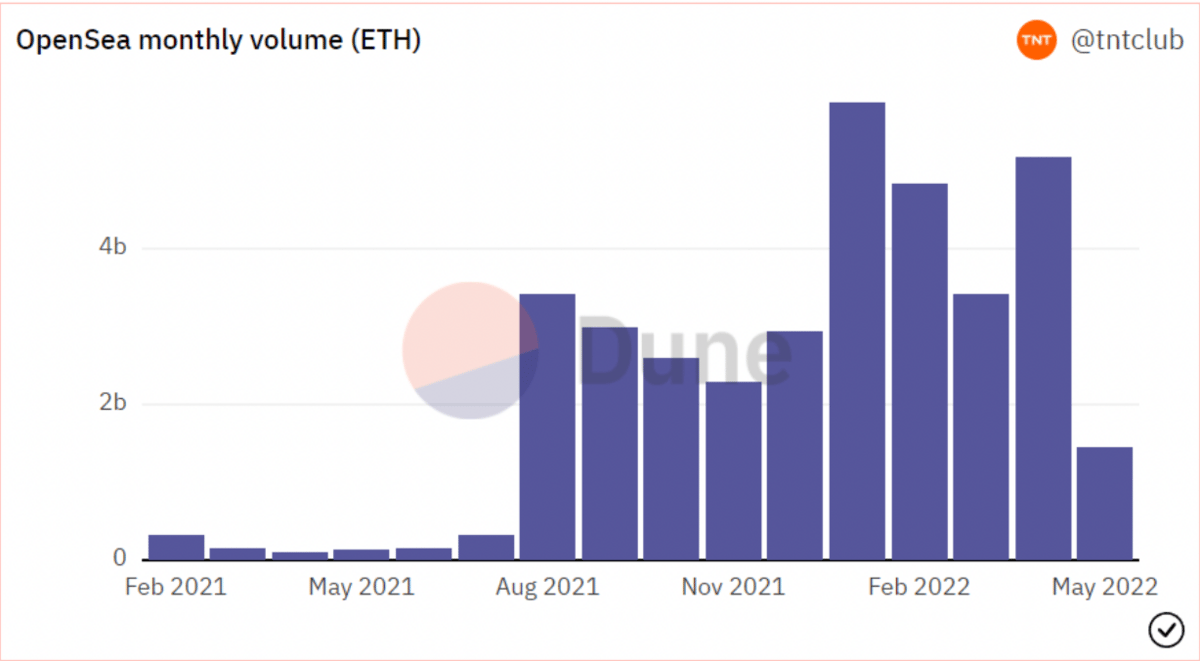

Stat: Despite a widely circulated WSJ report on allegedly cratering NFT transaction volume, the April data on OpenSea (courtesy of Dune Analytics) tells a different story. In total $5.2 billion was traded on the platform, making April the second-highest month by volume in OpenSea history.

Stories we’re watching: Backstage Capital made the rare decision to commit to only investing in existing portfolio companies going forward. It’s pretty unprecedented to no longer invest in new companies, but founder Arlan Hamilton noted in an email to TechCrunch that Backstage’s investment cadence outpaces other funds so it's more a case “of being strategic and thoughtful in our approach,” she continued.

Rabbit hole: How iOS and Android came to dominate mobile (De Programmatica Ipsum).

WHAT ELSE IS GOING ON

Stripe launched a new product that looks suspiciously like Plaid, and Plaid’s CEO called out the Stripe PM in a now-viral Twitter post.

Netflix faces a lawsuit alleging it knowingly hid falling subscriber numbers throughout 2021 and 2022.

Peloton, the embattled stationary bike company, may sell up to a 20% stake in the business.

Yuga Labs refunded the Ethereum gas fees for all failed Otherdeed transactions.

GUESSTIMATE

It’s been a wild few weeks in NFTs with Moonbirds and Otherdeeds launching. Can you rank these five popular projects in order of volume on OpenSea over the last 7 days?

Azuki

Moonbirds

Crypto Punks

Otherdeed

Doodles

FUNDRAISING FRIDAY

Sorry for all the the doom and gloom right before the weekend, but this thread from David Sacks does a good job of rounding up some of the reasons why it feels like the vibe has shifted in recent weeks.

FOUNDERS CORNER

The best resources we came across this week that will help you become a better founder, builder, or investor.

🧱 12 interesting ideas around product-market fit

📉 Two patterns to avoid as a founder

⏭️ A thorough guide on how to raise follow-on capital

GUESSTIMATE ANSWER

1. Otherdeeds (1st overall)

2. Doodles (8th overall)

3. Moonbirds (10th overall)

4. Azuki (11th overall)

5. CryptoPunks (18th overall)