Gm. Yesterday, a Twitter user tagged Jack and asked him “what was your intent on Twitter and has it turned out the way you wanted?”

Jack’s response: “The biggest issue and my biggest regret is that it became a company.”

Well, rest easy Jack, it never made much money anyway.

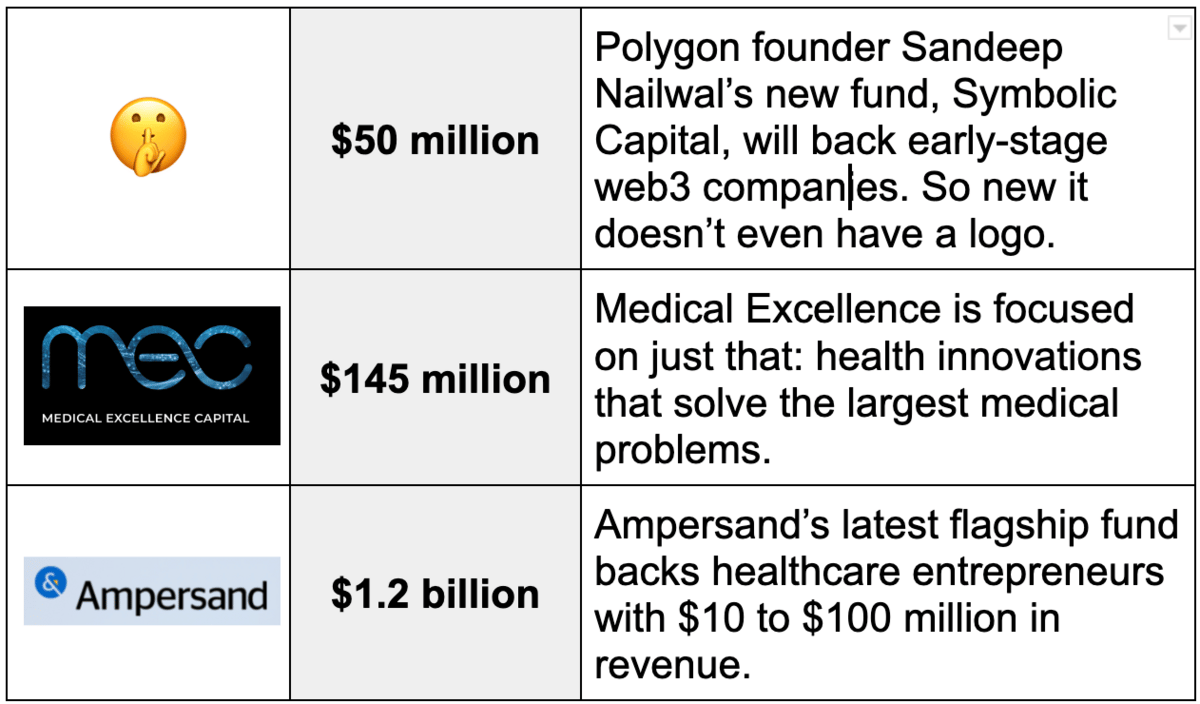

FRESH POWDER

Looking at three funds that recently topped up their coffers.

P.S. Want to see every fund we've shared in this section? Refer at least 1 person to Homescreen to get the full list.

DEAL MAKING

M&As took the summer off

Right now, the IPO market is drier than your DMs and on pace to raise the least amount of money since 2009. Usually, when this happens, the M&A market heats up as an alternative way for startups to exit…but that hasn’t been happening either.

So what is going on?

Last year, there were more than 3,000 M&A deals involving VC-backed companies according to Crunchbase. But more than halfway through Q3 of this year, just under 1,600 startups have been acquired or merged with another company.

One explanation for the drop-off is that private valuations are still stratospherically high. According to a CB Insights report analyzing Q2 of this year, valuations for tech startups are sitting 35% higher than 2020 levels. For series C and D, they’re more than 100% higher.

Despite a major sentiment turn and funding slowdown, private valuations have remained remarkably resilient. Only 81 down rounds have been recorded this year per Pitchbook, a lower than expected total given the state of the broader economy. But private valuations eventually need a release valve in order for the venture ecosystem to work as intended.

We could be reaching a tipping point

Either the IPO or the M&A market will likely heat up in the coming months. Summer, a notoriously quiet period for dealmaking, is drawing to a close. Also, due to rising interest rates, the money needed to put these deals together has been more expensive. With inflation coming back into check, interest rates should level out sparking more activity.

Bottom line: The wild fundraising boom of 2020 has left companies sitting on piles of cash so there isn’t a ton of urgency from companies to find an exit path…yet. As coffers run dry, there will likely be an uptick in cash-strapped companies looking for possible suitors. “I think you will see M&A pick up in Q1 next year,” Mike Ghaffary, general partner at Canvas Ventures, told CrunchBase.

EARNINGS

Yikes, Peloton

Yesterday, Peloton reported earnings so pathetic that not even Jess Sims could put a positive spin on them. Revenue fell 28% year-over-year leading to a record $1.2 billion quarterly loss. Now the embattled bike maker faces some existential questions around the future of the company.

Here are two possible ways Peloton could right the ship.

Premium content: On the earnings call yesterday, Peloton CEO Barry McCarthy said “It is not enough to just cut expenses, we have to grow revenue.” His plan for doing that? Introduce a premium content tier. While McCarthy was light on specifics he did mention reaching the “steaming audience” which could signal that Peloton is expanding away from just fitness classes. Peloton+ anyone?

Amazon acquisition: On Wednesday, Peloton’s stock jumped 20% on news that Amazon began listing Peloton equipment on its site. Investors no doubt saw the news as the first step towards a potential acquisition. Amazon would get a well-known fitness brand to help it compete with Apple, while Peloton would be afforded a huge distribution boost and maybe even a subscription meld with Prime. Tasty for everyone involved.

Bottom line: Peloton is struggling now, but there is light at the end of the stationary tunnel.

QUICK HITS

Seed Round

Stat: “When I grow up, I want to be an astronaut”...said no kid in 2022. Instead, 1 in 4 Gen Z-ers want to be social media influencers according to a HigherVisibility survey. Two other stats caught our eye: more kids from New York than LA want to become influencers (41% v. 30%), while more men care about their follower count than women (35% v. 31%). The least surprising finding rounded out the report: 20% of the youths felt their older counterparts didn’t understand social media influencing.

Story we’re watching: Amazon is shutting down its internal telehealth service as it seeks to revamp its healthcare offerings. Unlike AWS which has become a massive commercial success, Amazon had trouble expanding its health services beyond its employees. Instead, it’s choosing to focus on building out its recent acquisition of One Medical (which owns and operates more than 180 clinics across the US), launching it into direct competition with industry leaders like UnitedHealth and CVS.

Rabbit hole: Creativity requires solitude (DKB Show).

WHAT ELSE IS GOING ON

Hacker group 0ktapus revealed it breached more than 130 companies, snatching the credentials of nearly 10,000 employees along the way.

How to tell if you qualify for student loan forgiveness under Biden’s new plan.

California announced plans to ban the sale of gas-powered cars entirely by 2035.

Google launched AI Test Kitchen, an app that lets users test out experimental AI like its controversial language model LaMDA.

GUESSTIMATE

Let’s play "above or below." The rules are simple: For the five companies listed, guess which ones are currently trading above or below their IPO valuations.

Peloton

Uber

Moderna

Draftkings

Snowflake

Answers are at the bottom of the newsletter.

FUNDRAISING FRIDAY

There’s still money flowing in the venture world. Here are 10 actionable fundraising tips from the best founders and investors in the game:

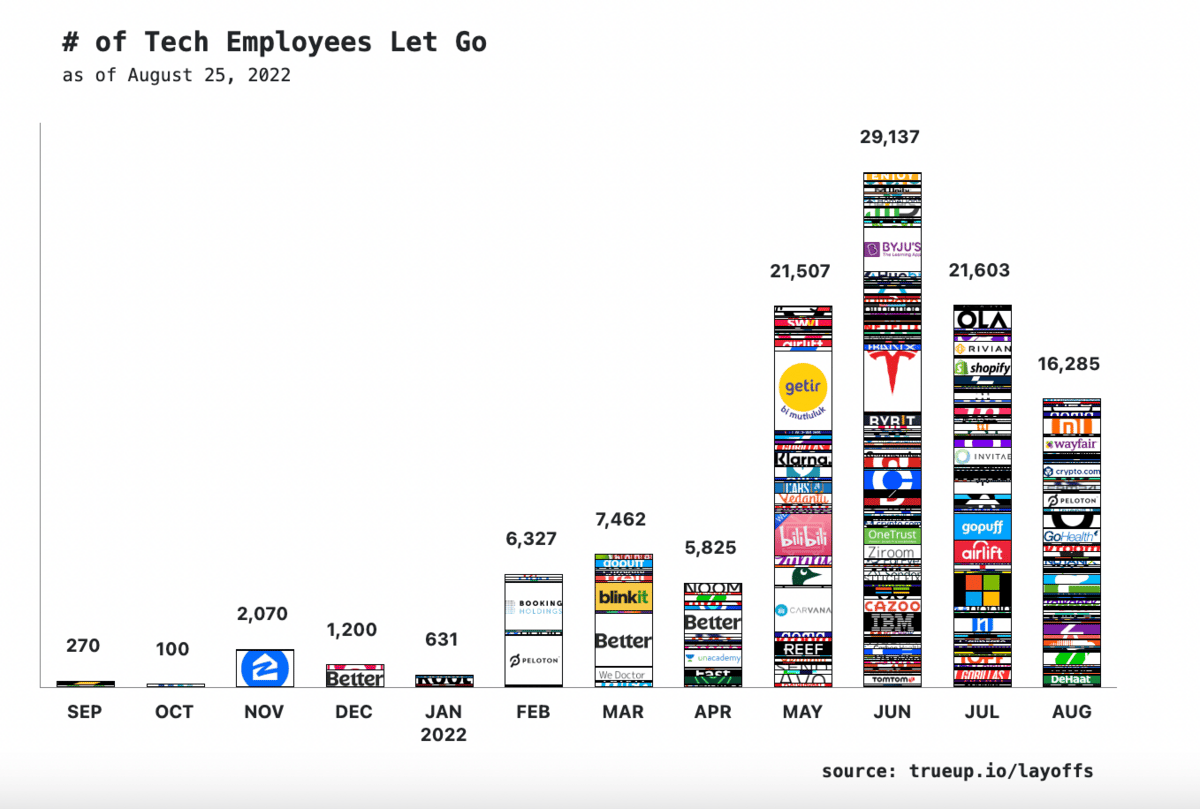

LAYOFFS TRACKER

Notable layoffs this week:

DataRobot: 234 people (26%)

Tier: 180 people (16%)

Packable: 138 people (20%)

FOUNDERS CORNER

The best resources we came across this week that will help you become a better founder, builder, or investor.

🏘 50+ curated resources for anyone joining or launching a coliving house

🔜 How to become a Web3 DevRel in 6 months

⮑ Understanding how "dollars returned" works for founders

💵 80,000 startups trust Mercury to help them scale from pre-seed to IPO and beyond—take their free demo for a test drive to see why.*

*This is sponsored advertising content.

GUESSTIMATE ANSWER

Peloton: below

Uber: below

Moderna: above

Draftkings: above

Snowflake: below