Gm. Boris Johnson resigned as Prime Minster yesterday which means we are t-minus one week from him launching his own NFT collection and getting a $100 million podcast deal from Spotify.

Can’t wait.

FRESH POWDER

Looking at three funds that recently topped up their coffers.

Startup to watch: YuLife is a life insurance company with an innovative spin: help policyholders live longer by offering wellness and fitness services. We’re calling it Living-as-a-Service (LaaS). Over 500 businesses leverage YuLife for their employees and the company just raised a $120 Series C at an $800 million valuation. (More here)

VALUATIONS

Founders embrace the pain

Startup founders, in general, are not big fans of graphs that go down and to the left…unless that graph is showing their 409A valuation. Here’s why more and more founders are coming to embrace less-than-stellar third party valuations in the current market.

First, some definitions

409A valuations are appraisals, often from third party companies, that determine the price at which a startup issues stock options to its employees.

It’s important to note that a 409A valuation is totally separate from the paper valuation set by investors who contribute capital to the company.

While a big external valuation sends bullish signals to other investors and makes founders “rich” on paper, a 409A doesn’t have the same impact. In fact, the less a 409A provider thinks a startup is worth, the better the price employees get on their stock options (and the greater the potential for profits when they exercise them).

Startups are embracing the cuts

The most high-profile company to announce a markdown was Instacart back in March when a 409A appraisal slashed its value from around $39 billion to $24 billion, a roughly 40% markdown.

Instacart told concerned investors and employees that the cut would end up granting new employees more shares. It sounded like a spinzone at the time, but more and more companies are following its lead.

Sendbird, a communications software startup, saw its valuation cut from $1.1 billion in 2016 all the way to $6.5 million this year, but CEO and cofounder John Kim told the Information that he actually “prefers a conservative 409A valuation,” because he can use it as a recruiting tool.

Zoom out: While companies appear to have embraced their suddenly smaller valuations, the logjammed IPO market might dampen the allure of cheaper employee shares. After all, what good are cheap shares if there is little hope to redeem them in the future? Until the IPO market sparks back to life, 409A valuation cuts may not be as effective at retaining talent as CEOs hope them to be.

HACKS

This is why no one uses LinkedIn

When your new job doesn't actually exist

In March, the North Korean hackers group Lazarus stole over $625 million from the play-to-earn game Axie Infinity in one of the biggest crypto heists ever. Months later, we finally know how they pulled off the sophisticated scheme: DMing people on LinkedIn.

Yes, you heard that right. One of the most notable exploits in crypto history went down in the LinkedIn DMs. According to a new report from The Block, the hackers posed as recruiters for a new crypto company that, in reality, did not exist. One Sky Mavis engineer took the bait.

The hackers led the candidate through multiple rounds of interviews before sending them "an extremely generous compensation package" that was laced with spyware.

Once downloaded, the fake offer letter gave the hackers a clear path to the nodes that Sky Mavis uses to validate on-chain financial transactions.

Bottom line: Sky Mavis was skewered at the time of the hack for how easily they lost control of the validator nodes. But now that the details show it was human error—not a fundamental flaw with the blockchain—that caused the issue, the game developer comes out of this looking a little better.

QUICK HITS

Seed Round

TechCrunch

Stat: A new survey from Zipline on intragenerational shoppers confirmed what we’ve all been thinking: the metaverse is, like…kinda meh? That’s if you know what “metaverse” even means — 43% Gen Z reported a lack of understanding about the metaverse and 85% said they’re “indifferent about brands developing a presence in the metaverse.” Nonetheless, when it came to shopping in virtual reality, the majority of generations (85% of GenZ, 75% of millennials, and 69% of GenX) were in full support.

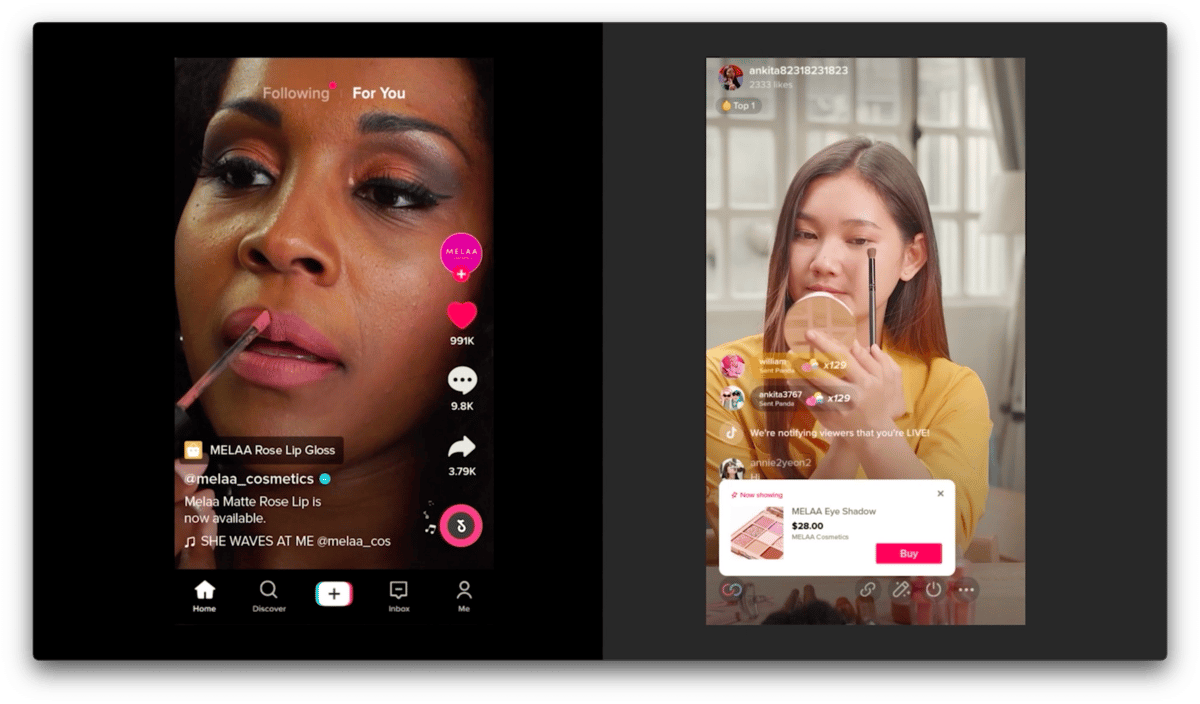

Story we’re watching: TikTok loves short-form so much that they abandoned their ambitious “TikTok Shop” initiative in the US before it even rolled out. The plan was scrapped after the live-ecommerce feature failed miserably in the U.K., marked by poor sales, influencer disinterest, and internal disputes. Maybe attention, not dollars, is TikTok’s true currency after all…

Rabbit hole: How Wish went from market darling to failed IPO in two years (New York Times)

WHAT ELSE IS GOING ON

Sunny Balwami, Theranos’ ex-CEO, was found guilty on all 12 criminal fraud charges.

Twitter is experimenting with CoTweets, a new feature that would allow two accounts to co-publish a single tweet.

Reddit is launching a new NFT-based avatar marketplace.

Elon Musk, who had secret twin babies with a Tesla exec, says he’s just doing his part to curb ‘the underpopulation crisis.’

GUESSTIMATE

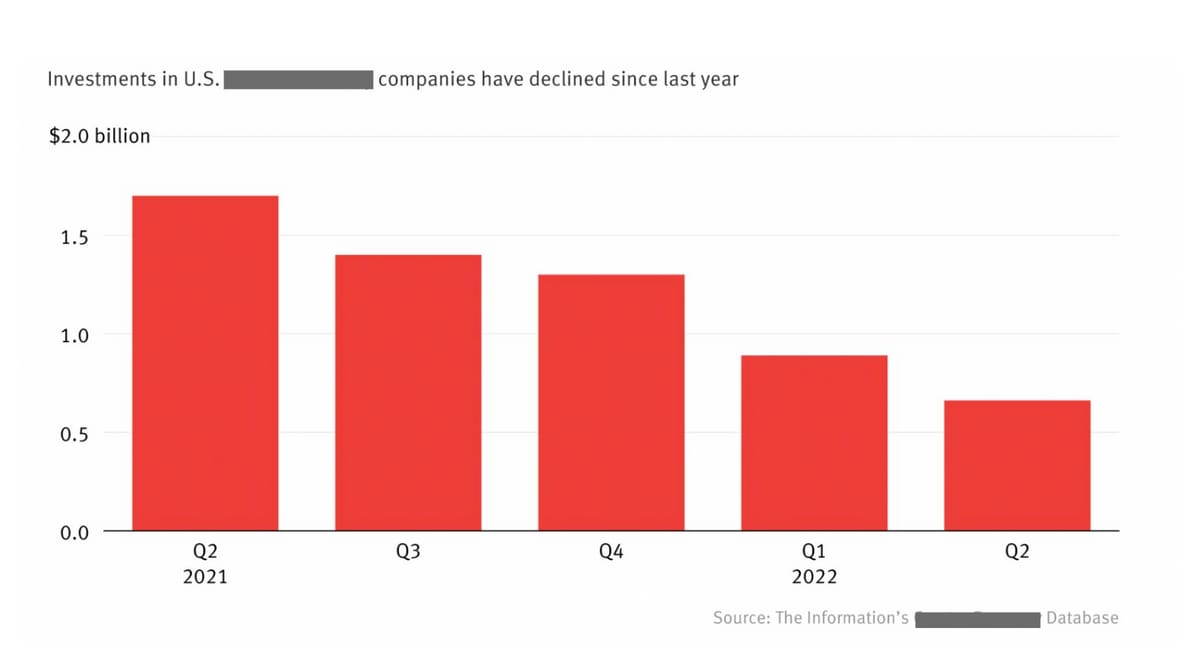

Funding for _______ startups dropped more than 60% from the same period last year.

What goes in the blank?

FUNDRAISING FRIDAY

Pre-money and post-money valuations can be confusing.

This helpful thread explains the difference:

LAYOFFS TRACKER

True Up

Notable layoffs this week:

Remote: 100 people (9%)

eToro: 100 people (6%)

Loft: 380 people (12%)

FOUNDERS CORNER

The best resources we came across this week that will help you become a better founder, builder, or investor.

⌨️ Every software developer should know these technical skills.

🤝 11 learnings on leadership, entrepreneurship, and startups.

🙋How to raise a Series A in today’s climate.

GUESSTIMATE ANSWER

Creator Economy