Gm. With Kevin Durant requesting a trade from the Nets, the only thing more chaotic than crypto right now is the NBA trade market.

And if neither of those things means much to you, we envy your mental tranquility.

FRESH POWDER

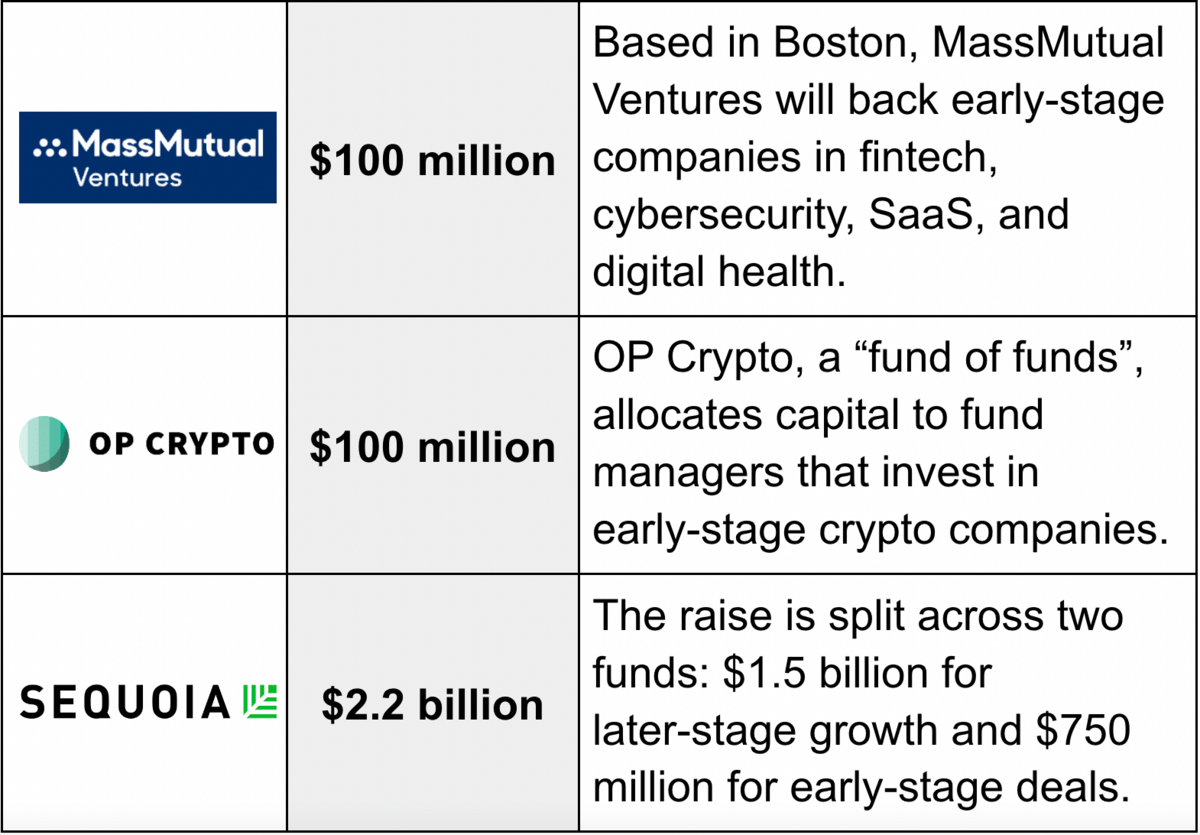

Looking at three funds that recently topped up their coffers.

Startup to watch: Tomorrow Health is spearheading the “health-from-home” movement. Their technology connects medical providers with the 25% of Americans who require home-based care. They just raised a $60 million Series B from a star-studded lineup that includes BOND, a16z, and Obvious Ventures (More here).

CRYPTO

Three Arrow Capital forced to empty the quiver

Once one of the biggest crypto hedge funds in the world, Three Arrow Capital (3AC) has been ordered by an international court to liquidate its holdings. It’s a stunning fall from grace for the bull market darling with far-reaching implications across the crypto world.

What the hell happened?

Like most of the disastrous crypto liquidation events we have seen during this bear market, things started unraveling for 3AC after the collapse of TerraLuna. 3AC cofounder Kyle Davies told the WSJ that "the TerraLuna situation caught us very much off guard," which translated to $200 million loss for the fund.

That sizable L prompted people to look a little closer at 3AC's use of leverage. It soon became clear that 3AC was essentially trading like a full-on degen with the risk management of Enron.

The biggest risk: 3AC held a massive margin long position on BTC with a liquidation price of around $24,000—a level that bitcoin breached earlier this month.

That’s when the margin calls started coming in

Anyone who had loaned money to 3AC started liquidating its positions, causing bitcoin to drop even further to $20,000.

On Monday, digital asset brokerage Voyager Digital revealed that 3AC had defaulted on a $670 million loan from them.

Market maker and lending firm Genesis Trading is also reportedly facing potential losses in the “hundreds of millions” due to its exposure to 3AC.

But the biggest shock is that the crypto brokerage startup BlockFi had also loaned $1 billion to 3AC.

Zoom out: The collapse of 3AC has led to increased fears of contagion rippling through the crypto markets. But one hero man appears ready to steady the ship: Sam Bankman-Fried. Yesterday, CNBC reported that FTX is set to buy BlockFi for a measly $25 million, 99% below its last private valuation. It would be another stunning acquisition for FTX who seems to be the only crypto institution with the acumen, and funds, to stabilize the ecosystem right now.

SOCIAL MEDIA

RadioShack refuses to go radio silent

The once family-friendly electronics store RadioShack is blowing up on Twitter after a string of tweets that would make Elon blush.

Some of the more graphic sexual material has since been deleted, but yesterday, the supposed “intern” behind the account doubled down refusing to apologize saying “ik that sh*t was fire af.”

The backstory

The RadioShack your parents know and love was approaching death’s doorstep in 2017 after filing for bankruptcy for a second time. But in March, it launched a hail mary effort to rebrand as—you guessed it—a crypto swapping platform similar to Uniswap.

Called RadioShack Swap, it actually hasn’t been a complete failure with a total trading volume of nearly $40 million as of last month.

Zoom out: So is the "horny brand account" trope paying off for the Shack? It depends on how you measure success—Its Twitter account gained nearly 100,000 followers in the last week, but the token associated with its swapping platform, $RADIO, is down 38% in the last month.

QUICK HITS

Seed Round

Carta

Stat: All the think pieces about the office being dead forever may have been...correct? Remote hires now represent 62% of all new contracts signed by startup employees compared to 35% three years ago, per a Carta report. While remote employees are being liberated from commuter traffic, they are also being let go more frequently—firings accounted for 29% of total employee departures last year, compared to 15% a year prior.

Story we're watching: Niantic, the brains behind Pokémon Go, is launching a new social app called Campfire that is a sort of Snapchat heat map for augmented reality activations. It will include the locations of nearby AR events as well as private messaging tools. We've covered Niantic's goal to build an 3D AR layer for the entire world in the past and Campfire's launch is the first step in making that a reality.

Rabbit hole: 24 charts that show we’re (mostly) living better than our parents (Full Stack Economics).

WHAT ELSE IS GOING ON

OpenSea reported a huge data breach that likely includes the emails of all their users.

CoinFLEX has revealed that famous crypto investor Roger Ver is the whale whose account went negative, a claim Ver denies.

The S&P 500 closed out its worst performance in the first half of the year since 1970.

TikTok is testing a “Shop” feature that would let users browse and purchase products in the app.

GUESSTIMATE

On Tuesday Elon Musk passed 100 million Twitter followers, becoming the 6th person to join the 9-digit club.

Can you guess who the other 5 accounts in the club are?

FUNDRAISING FRIDAY

Raising a seed round? Sam DeBrule shared a thread breaking down the pitch deck that helped him snag $6.5 million from Spark Capital.

LAYOFFS TRACKER

We're switching up Layoffs Tracker a little bit today.

Here’s a visual representation of just how bad June was for tech and startup employees.

True Up

FOUNDERS CORNER

The best resources we came across this week that will help you become a better founder, builder, or investor.

🃏40 project ideas that Future Fund wants you to launch

✍️ 10 resources to improve your writing game

💃 How to acquire customers with TikTok

GUESSTIMATE ANSWER

Barack Obama (132.1 million)

Justin Bieber (114.1 million)

Katy Perry (108.8 million)

Rihanna (106.9 million)

Cristiano Ronaldo (101.3 million)