Gm. Shares of English soccer team Manchester United jumped 17% on Wednesday after Elon Musk jokingly tweeted “Also I’m buying Manchester United ur welcome.”

Elon, if you’re reading this, maybe slip Vanguard Institutional Index into your next tweet. Our 401ks thank you.

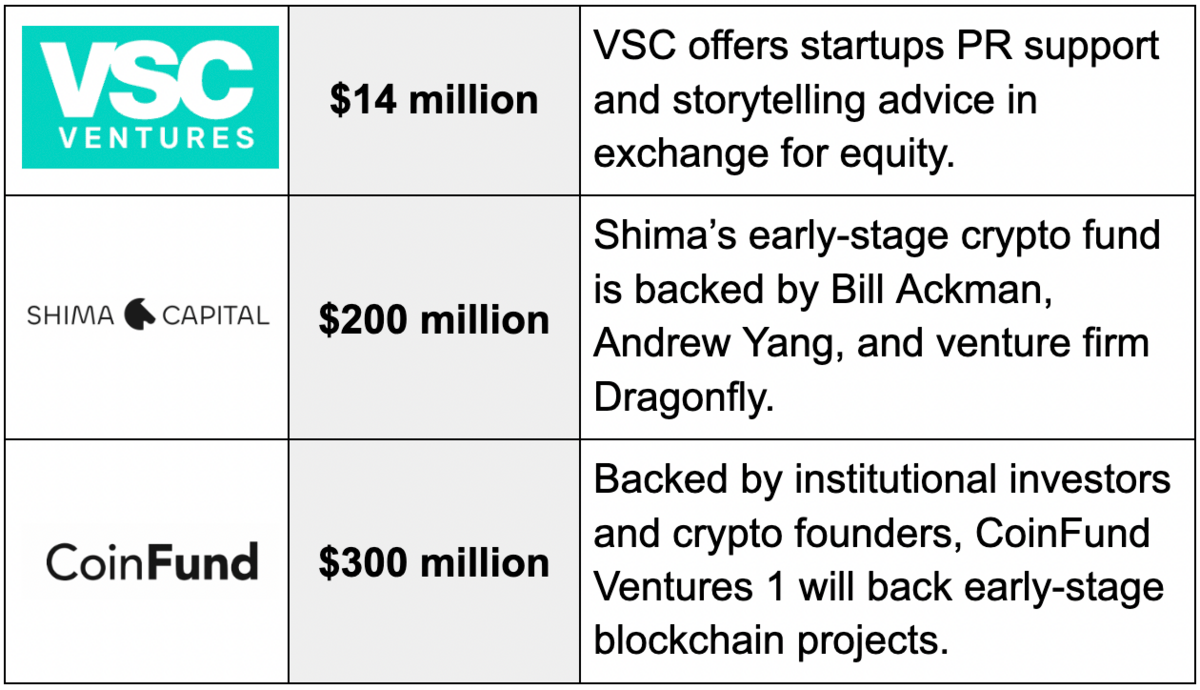

FRESH POWDER

Looking at three funds that recently topped up their coffers.

SEMICONDUCTORS

China chirps the US over chips

The storm clouds brewing between China, the US, and Taiwan are growing into a towering cumulonimbus. And if trade is the thunder, semiconductors are the lightning. Yesterday, China’s commerce ministry released a statement opposing the CHIPS act passed by the US and threatened to take “forceful measures” to protect Chinese interests where necessary.

The backstory

Semiconductors have long been a delicate part of the global supply chain. When the pandemic interrupted production, North American auto companies manufactured 3 million fewer new cars which caused used car prices to spike and generated close to “one-third of all inflation.”

In total, more than 70% of semiconductor manufacturing capability is located in the East Asian group of China, Taiwan, South Korea, and Japan. Taiwan in particular produces 90% of chips under 10 nanometers which are the most advanced and hardest to produce.

The East Asian monopoly on chip production prompted Washington to pass the CHIPS and Science Act earlier this month which allocated $50 billion toward semiconductor manufacturing in the US.

China hates CHIPS

America’s renewed focus on domestic chip production poses a direct threat to China. If the US were to sanction China and prevent it from accessing the leading-edge technology developed by the US and its allies, China would be in a world of hurt.

Enter Taiwan: The Defense Department believes that China is likely preparing to unify Taiwan with China “by force. In the event of an invasion, China would gain access to Taiwan's incredibly valuable manufacturing capabilities.

If that happens, the US and other counties would still dominate chip-making technology, but China would control a huge amount of the manufacturing testing, and packaging process. If they were to sanction the West, it could trigger a worldwide industrial depression.

Zoom out: Setting geopolitical implications aside, the CHIPS act also represents a major boost for US startups. Military funding during the Cold War led to the rise of OG Silicon Valley companies like Fairchild Semiconductor and laid the groundwork for the Silicon Valley we know today. The new conflict with China and the injection of funds from the CHIPS act could have the same trickle-down effect on innovation.

GAMES

Middle Earth is heading to Sweden

Giphy

Embracer Group, a media and entertainment company that focuses on gaming, snapped up the worldwide rights to The Lord of the Rings franchise yesterday as part of a six-piece deal totaling $573 million.

The new deal lets Embracer adapt Tolkien’s IP into new movies, video games, merchandising, and even theme parks. The acquisition comes just ahead of the highly-anticipated premiere of Amazon’s “Rings of Power” series on September 2 which will give fans their first taste of LOTR since 2014.

Embracer has been on a heater: It recently acquired the rights to iconic gaming titles like Tomb Raider, Deus Ex, and Thief to go along with its portfolio of more than 100 studios.

Bottom line: With global video game sales declining for the first time in years, there’s been a rash consolidation at the very top of the industry—notably Microsoft’s acquisition of Activision for $70 billion and Unity’s $4.4 billion merger with ironSource—to go along with Embracer’s spending spree.

QUICK HITS

Seed Round

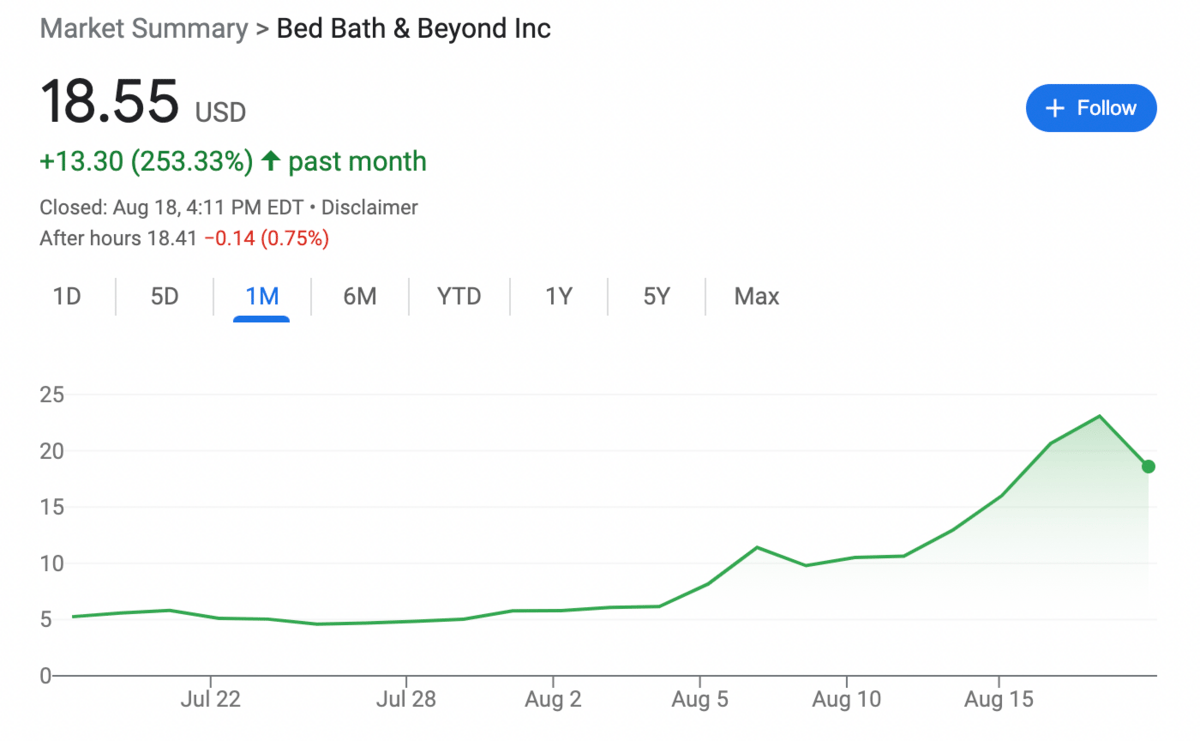

Stat: Amatuer stock trader Jake Freeman is proof that the best way to get rich is to start rich. The 20-year-old college student turned $25 million into $110 million through a well-timed bet on the meme-stock Bed, Bath, & Beyond which tripled in value over the last month. Freeman also sold his stake right before it plunged 20% on news that the retailer’s chairman Ryan Cohen would dump his entire position. How did a college kid come by $25 million in the first place? Mostly through “friends and family.” Freeman Thanksgivings must be quite the affair.

Story we’re watching: The TikTok-to-FAANG copycat pipeline is stronger than ever. This time it’s Amazon testing out a TikTok-like video feed that lets merchants post short videos featuring their products that customers can browse. It’s part of a broader content strategy for Amazon, which also recently introduced a feature called Posts that lets advertisers showcase their products through Instagram-esque pics and captions. On a long enough timeline, everything becomes TikTok.

Rabbit hole: The frontrunners in the trillion-dollar race for limitless fusion power (Fast Company).

WHAT ELSE IS GOING ON

Google’s employee union is demanding abortion care benefits for contractors in states with abortion bans.

Dan Price, the CEO of Gravity Payments who constantly brags about taking a paycut, has resigned following misdemeanor assault charges.

Adam Neumann’s freshly funded real estate project Flow plans on building a digital wallet that stores crypto assets.

Crypto.com quietly let go of hundreds more employees since its original layoffs in June.

GUESSTIMATE

Tolkien’s Middle Earth—which includes three LOTR movies and three Hobbit movies—is number 10 on the list of highest-grossing film franchises of all time.

Can you list the nine others ahead of it?

FUNDRAISING FRIDAY

You know about product-market fit.

But you might not be aware of funding-market fit.

Make sure the round you are raising makes sense for VCs to participate in.

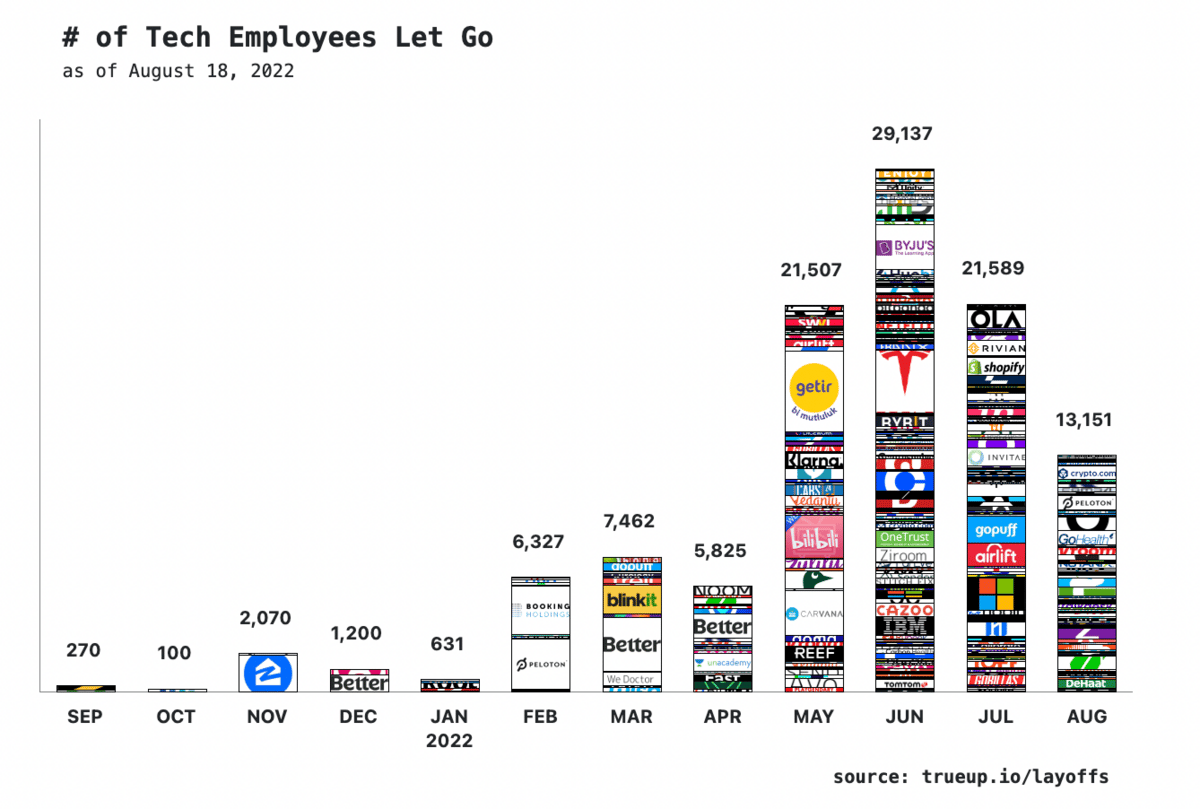

LAYOFFS TRACKER

Notable layoffs this week:

Genesis: 52 people (20%)

Swyftx: 74 people (21%)

New Relic: 110 people (5%)

FOUNDERS CORNER

The best resources we came across this week that will help you become a better founder, builder, or investor.

🤷 Crazy (and brilliant) ways people have made money

👩💻 How to get great senior women to join your company

👔 The best newsletter for budding creators and audience builders

GUESSTIMATE ANSWER

Marvel: $26.6 billion

Star Wars: $10.3 billion

Harry Potter: $9.6 billion

Spider-Man: $8.3 billion

James Bond: $7.9 billion

Avengers: $7.8 billion

Batman: $6.8 billion

Fast and the Furious: $6.6 billion

X-Men: $6.1 billion

Lord of the Rings: $5.9 billion